Is there an immediate practical application for Bitcoin?

Yes, and "It's going up forever, Laura."

(Below is a recent Q&A from a client learning about Bitcoin. I made some minor edits prior to sharing here. Also, I reference Parker Lewis’ essay Bitcoin is not a Hedge below. When I eventually get around to creating a top 10 Bitcoin Article List, it’ll likely be on it.)

Q: With BTC, I find it uniquely paradoxical that I have to use dollars to participate in it, when the purpose of it seems to be to override the fiat system altogether. Am I buying it strictly as a hedge against inflation and monetary collapse or is there some immediate practical application as well?

A: First, we have to use dollars because that’s the currency that has been decided for us. Non-voluntary. We didn’t choose Dollars. We were born into it (and thankfully it’s prettiest horse at the glue factory). We earn, save, and invest in dollars. To exit the dollar system, therefore we must elect to voluntarily use those same dollars.

Since we can’t vote against money printing/inflation at the ballot, we can and should vote with our wallet. This is freedom and Bitcoin represents a free market for money vs. money by government decree forced on us. (Reminder: we have the privilege of the dollar being the world’s reserve currency so our purchasing power decreases slower than the rest. Citizens in more despotic governments are already utilizing bitcoin to escape monetary debasement. Americans are blind to this global plunder because of our privilege. Reference Alex Gladstein’s “Check Your Financial Privilege” on my recommended book list to learn how Bitcoin as an insurance policy is already being applied in real life.

I sent you Parker Lewis’ essay yesterday (prior to this message). It’s illuminating and he makes incredibly logical points throughout. Bitcoin’s fixed supply of 21 million is the antidote to infinite fiat. Quite simply, it’s not a hedge. Bitcoin is a natively designed internet money for the digital age to be the solution to political money. Never before in history has money existed with the sound money characteristics of gold (but better) and the ease of transport of fiat without need for a 3rdparty to custody, secure, or give permission. True economic freedom. Parker points out the reason why Bitcoin is volatile in fiat price so I won’t repeat here and trust you have read or listened to his essay.

Beyond owning Bitcoin first as a form of insurance against inevitable fiat devaluation or outright collapse, there is second use case or “immediate practical application”: as an investment.

Here’s why.

Everyone is essentially forced to invest to stay ahead of money debasement. So it’s no stretch of the imagination to state that an investment portfolio represents a money alternative to our broken money. If our money wasn’t broken, we wouldn’t have take investment risk with the majority of our savings. Sound money would protect us against loss of purchasing power.

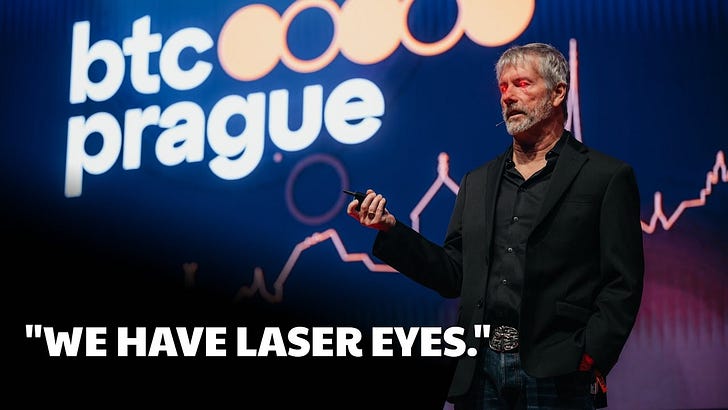

Since we must invest to outpace inflation, I’ll let Michael Saylor elucidate on why people are better off choosing Bitcoin as investment:

33 minutes for his presentation in Prague and you’ll want sit thru each minute and take notes.

By the way, guess which asset is the best performing investment over the last 5, 10, and 15 years (and has only been around since 2009)?

As he is often quoted saying: “there’s no 2nd best” and if you didn’t realize it, Saylor also coined,"It's going up forever, Laura."

This is what happens when absolute scarcity meets unlimited fiat. You might want to pick some up if it catches on…

Cheers,

John

Follow me on X/Twitter